Self-Employed W-2 Vs. Schedule C For 2024

If you are looking for Ep 2: Standard Deductions in Personal Tax Return vs Schedule C – YouTube you’ve came to the right web. We have 15 Pics about Ep 2: Standard Deductions in Personal Tax Return vs Schedule C – YouTube like Ep 2: Standard Deductions in Personal Tax Return vs Schedule C – YouTube, Schedule E vs Schedule C for Short-Term Rentals and also 2021 W-4 Form: What HR Leaders Need to Know | Paycor. Here you go:

Ep 2: Standard Deductions In Personal Tax Return Vs Schedule C – YouTube

Photo Credit by: www.youtube.com

Schedule E Vs Schedule C For Short-Term Rentals

Photo Credit by: theshorttermshop.com

Schedule C Vs Schedule E For Airbnb Income

Photo Credit by: sharedeconomycpa.com

Self-Employed & Taxes: Schedule C Vs S Corporation

Photo Credit by: cpainthesky.blogspot.com corporation employed

Schedule C Vs Schedule E For Airbnb Income

Photo Credit by: sharedeconomycpa.com

Understanding Your Tax Forms: The W-2

Photo Credit by: www.forbes.com form w2 tax box taxes forms understanding income withheld state security social employee sample number employer medicare information file federal

Schedule E Vs Schedule C For Short-Term Rentals

Photo Credit by: theshorttermshop.com

√100以上 1099 Schedule C Tax Form 315657-What Is A Schedule C 1099 Form

Photo Credit by: jossaesip3diz.blogspot.com

2021 W-4 Form: What HR Leaders Need To Know | Paycor

Photo Credit by: www.paycor.com paycor hr

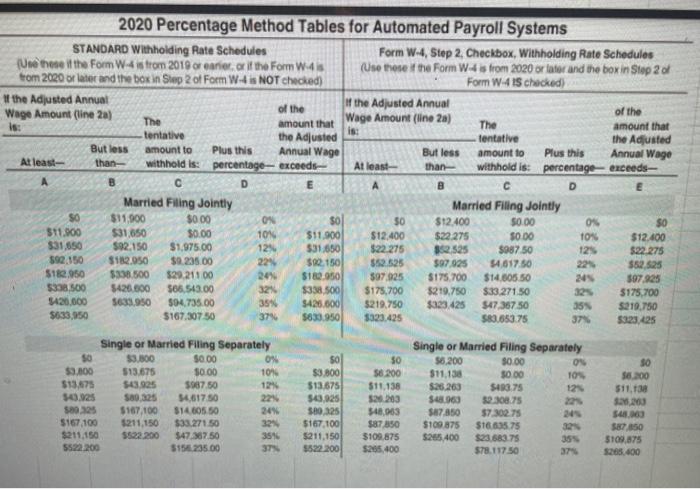

Does The Irs Flag Social Security Numbers – About Flag Collections

Photo Credit by: www.udimagen.org wage irs ageras

What Do I Do With My Self Employed Taxes? – Drive Now Network

Photo Credit by: drivenownetwork.com employed

S-Corp Avoids Self-Employment Taxes [Form 1120S Vs Schedule C] Save 15.

![S-Corp Avoids Self-Employment Taxes [Form 1120S vs Schedule C] Save 15. S-Corp Avoids Self-Employment Taxes [Form 1120S vs Schedule C] Save 15.](https://i.ytimg.com/vi/wVDx4TdggZ8/maxresdefault.jpg)

Photo Credit by: www.youtube.com

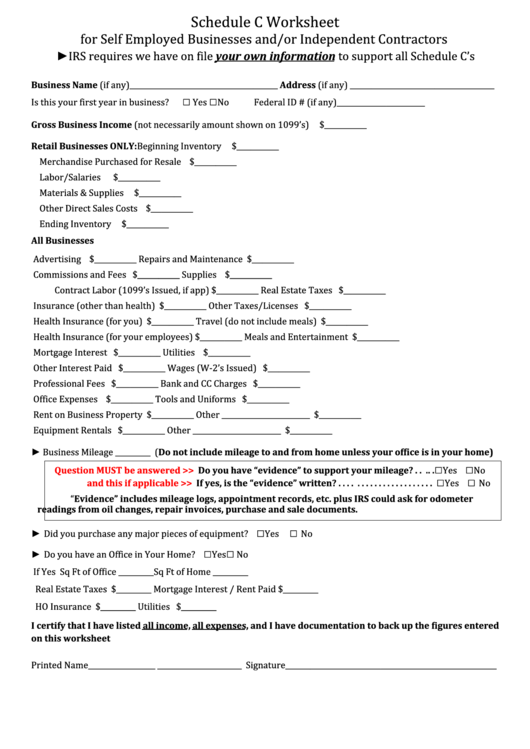

Schedule C Worksheet For Self Employed Businesses Printable Pdf Download

Photo Credit by: www.formsbank.com schedule self worksheet employed pdf printable businesses template

Stated Income For Self Employed & W2 Borrower

Photo Credit by: pacificwide.com income stated self voe employed w2 loan mortgage program borrower statement bank month choose board programs

Solved An Employee Has On File A 2019 W-4 Form With Box 2 | Chegg.com

Photo Credit by: www.chegg.com

Self-Employed W-2 Vs. Schedule C For 2024: Solved an employee has on file a 2019 w-4 form with box 2. Self-employed & taxes: schedule c vs s corporation. Wage irs ageras. Corporation employed. 2021 w-4 form: what hr leaders need to know. Schedule c vs schedule e for airbnb income

About the author